Our customer support team is here to answer your questions. Ask us anything!

Chat with us on WhatsApp

Written By: Flipbz.org

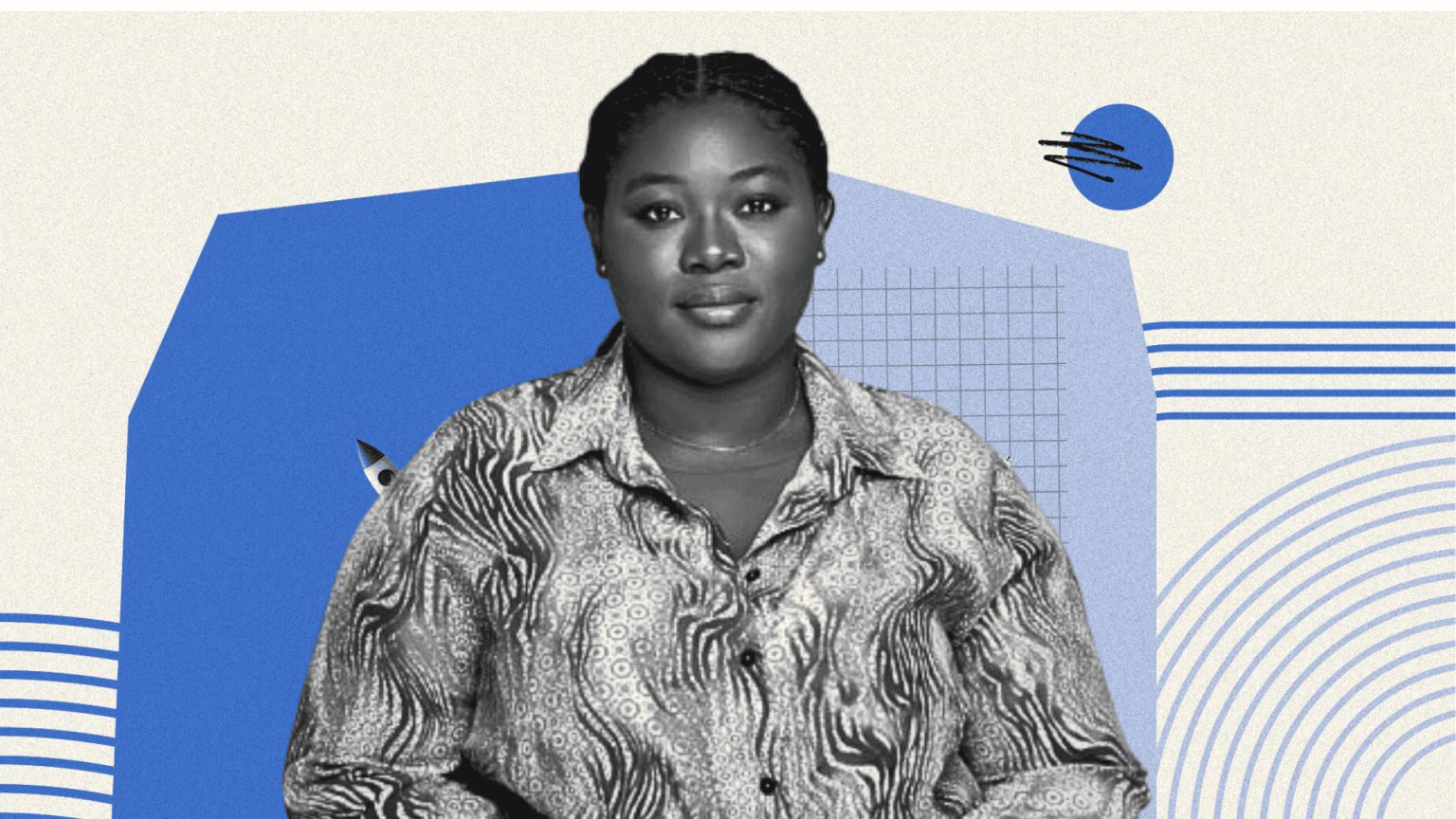

Nigeria's bustling informal sector powers more than half the nation's economic engine, yet for countless small traders and shop owners, snagging a simple loan feels like chasing a mirage. Enter Hadi Finance, a Lagos-based upstart that's flipping the script on small business lending. Co-founder Bidemi Adebayo didn't set out to battle deep-rooted fears, but three years in, her team has turned empathy into their secret weapon, proving that trust isn't built with algorithms alone.

Back in 2022, Hadi kicked off not as a lender, but as a savvy distributor. Picture this: a sleek warehouse in Abuja stocked with essentials, catering to over a thousand eager retailers and churning through $100,000 in goods every month. The plan was straightforward, bring supplies closer to the markets with a hub-and-spoke setup that promised speed and ease.

Reality hit hard. These street-smart vendors were razor-sharp on costs. "You're quoting ₦3,000 for an item, but the next guy's undercutting at ₦2,950," Adebayo recalls with a wry laugh. Folks would hop in a taxi to hunt bargains rather than pay a premium for doorstep delivery. It was a gut punch. No one warns you how unforgiving the market can be.

That humbling stretch uncovered the true pain point. Retailers weren't short on suppliers, they were starved for working capital to keep shelves stocked and sales spinning. What started as a goods game morphed into a mission for financing, thrusting Hadi into the high-stakes world of credit where one wrong move could sink dreams.

Fast-forward to the midway mark, and Hadi was knee-deep in Nigeria's lending labyrinth. Forget the glamour of fintech apps, the real monster was mistrust. "Loans carry this heavy baggage here," Adebayo says. Borrowers whisper about shady operators who drag families into the fray or chase down debtors with threats. One whiff of "loan shark," and doors slam shut.

Hadi's antidote? Boots on the ground, literally. They ditched the cold digital grind for what Adebayo dubs the "human touch." Their inaugural borrower? Her own mom, a seasoned retailer whose word-of-mouth sparked a referral wildfire. From there, the playbook shifted: Frame loans not as debts, but as rocket fuel for expansion.

When an application lands, field reps fan out within half a day, eyes on the ground to tailor funds that fit like a glove. "We're right there at your stall, sizing up what you truly need," she explains. Speed is sacred, too, a promise of cash in hand within 48 hours. Agents cluster by neighborhood for quick strikes, blending street-level checks with just enough tech to keep things secure and swift.

Even when repayments stutter, Hadi leans in, not out. Support crews swing by with questions like, "What's tripping you up?" Struggling with slow-moving stock? They'll scout cheaper sources to get you back on track. "Our goal isn't to upend lives, it's to lift them," Adebayo insists. Word spreads, and suddenly, new sign-ups pour in from friends vouching for the difference.

Today, as Hadi eyes its next growth spurt, that relational core feels unbreakable. Adebayo credits her retail roots, her mom's daily grind mirroring the grit of every client they serve. Victory, for them, boils down to basics: Funds flow out and circle back, while backed businesses double or triple in stride.

The horizon brims with fresh offerings, invoice advances to smooth seasonal dips, gear loans for essentials like chillers, even toolkit add-ons to sharpen operations and harvest richer insights. In a landscape where suspicion runs deep, Hadi's edge shines through not in flashy code, but in genuine connection, the quiet force turning wary glances into loyal partnerships.

This isn't just finance, it's the quiet revolution small hustles have been craving.

Please register to comment.

With these components in place, your business...

Open the Listing model file located in the ap...

Discover promising partnership opportunities in various industries.

Pitch Your Startup | Find Partners

Comments